The big $10 billion: Apple’s Record-Breaking iPhone Exports from India

- InduQin

- Oct 8, 2025

- 3 min read

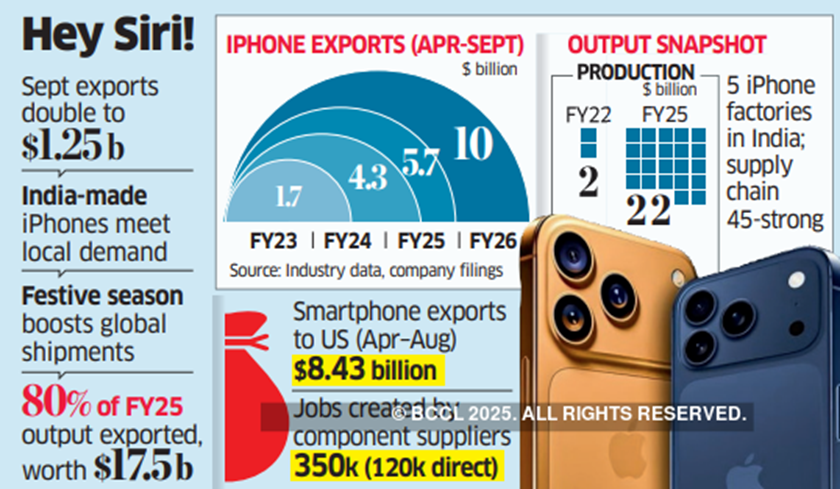

Apple exported iPhones worth $10 billion from India in the first half of this fiscal year, a 75% increase from last year. September alone saw $1.25 billion in exports, driven by the iPhone 17 series. With five factories, including new ones in Hosur and Bengaluru, Apple has scaled production, exporting 80% of its $22 billion output. India’s PLI scheme and global demand solidify its role as a key player in Apple’s supply chain.

Apple has achieved a remarkable milestone by exporting iPhones worth $10 billion (approximately ₹88,730 crore) from India in the first half of the current fiscal year. This represents an impressive 75% growth compared to $5.71 billion during the same period last year, according to industry insiders. The tech giant’s manufacturing and export activities in India continue to soar, reflecting its growing reliance on the country as a key global production hub.

September: A Game-Changing Month for Exports

Despite September traditionally being a slower month for iPhone shipments—due to users waiting for the annual launch of new models—Apple defied expectations this year. The company shipped $1.25 billion worth of iPhones in September alone, a staggering 155% increase compared to $490 million in the same month last year. This was achieved despite strong domestic demand for the newly launched iPhone 17 series, which is also produced in India.

Apple’s September launches play a pivotal role in driving export momentum, particularly as international demand surges during the festive season in the West. With events like Black Friday, Christmas, and New Year sales fueling purchases, Apple’s export volumes typically pick up pace after India’s Diwali celebrations. Notably, for the first time, all iPhone models—including the Pro, Pro Max, and Air—were available for global markets directly from India upon launch. Previously, there was a delay of several months before Pro models manufactured in India reached international customers.

Expansion of Manufacturing Facilities

Apple’s production capabilities in India have grown significantly with the addition of two new factories earlier this year. Tata Electronics’ plant in Hosur and Foxconn’s unit in Bengaluru, both inaugurated in April, brought the total number of iPhone manufacturing facilities in the country to five. This expansion has played a crucial role in boosting both production and exports.

In FY25, Apple’s vendors produced 22 billion worth of iPhones in India, of which 8022 billion worth of iPhones in India, of which 80%—valued at 22 billion worth of iPhones in India, of which 8017.5 billion—were exported. This marks a dramatic rise from just $2 billion worth of production in FY22. Industry experts anticipate further growth in the current fiscal year, although potential U.S. tariff changes and trade restrictions could pose challenges.

Impact of India’s Production-Linked Incentive (PLI) Scheme

Under India’s PLI scheme, smartphone manufacturers, including Apple, report production and export data regularly to the government. Incentives are calculated based on the Freight on Board (FOB) value, which reflects the cost of the device as it leaves the factory. Notably, the retail prices of iPhones are typically 50-60% higher than their FOB value.

The government’s PLI program has been instrumental in fostering Apple’s growth in India. By incentivizing local manufacturing, the scheme has encouraged Apple to rapidly scale its supply chain and production capabilities in the country.

India’s Role in Apple’s Global Supply Chain

India has emerged as a critical player in Apple’s global strategy, particularly amid geopolitical uncertainties. With nearly 45 local and international suppliers now part of its Indian supply chain, Apple has considerably expanded its component production and sub-assembly ecosystem. These suppliers have collectively created approximately 350,000 jobs, including 120,000 direct employment opportunities at component factories. This number is in addition to the substantial workforce employed by the five iPhone manufacturing units in India.

The U.S. as a Key Export Market

The United States continues to be the largest market for iPhone exports from India. According to the India Cellular and Electronics Association (ICEA), smartphone exports to the U.S. between April and August this year reached 8.43billion,comparedto8.43 billion, compared to 8.43billion,comparedto2.88 billion during the same period last year. Apple leads these exports, followed by competitors like Samsung and Motorola.

While current U.S. tariffs on Indian imports exclude smartphones, potential changes under the U.S. Department of Commerce’s ongoing semiconductor tariff investigations could impact future exports. However, industry analysts remain optimistic that Apple will surpass last year’s production and export figures, given its current growth trajectory.

A Bright Future for Apple in India

Apple’s rapid success in India underscores the country’s growing importance in the global electronics manufacturing landscape. By aligning its production strategies with India’s PLI incentives and leveraging its expanding supply chain, Apple has positioned itself as a leader in both domestic and international markets.

With all iPhone models now being manufactured in India from the outset and exported worldwide, the country is firmly cemented as a vital hub in Apple’s global operations. As production scales and new opportunities emerge, India’s role in shaping Apple’s future appears brighter than ever.

Comments